Ensure your coverage matches your

life stage, responsibilities, and long-term financial goals

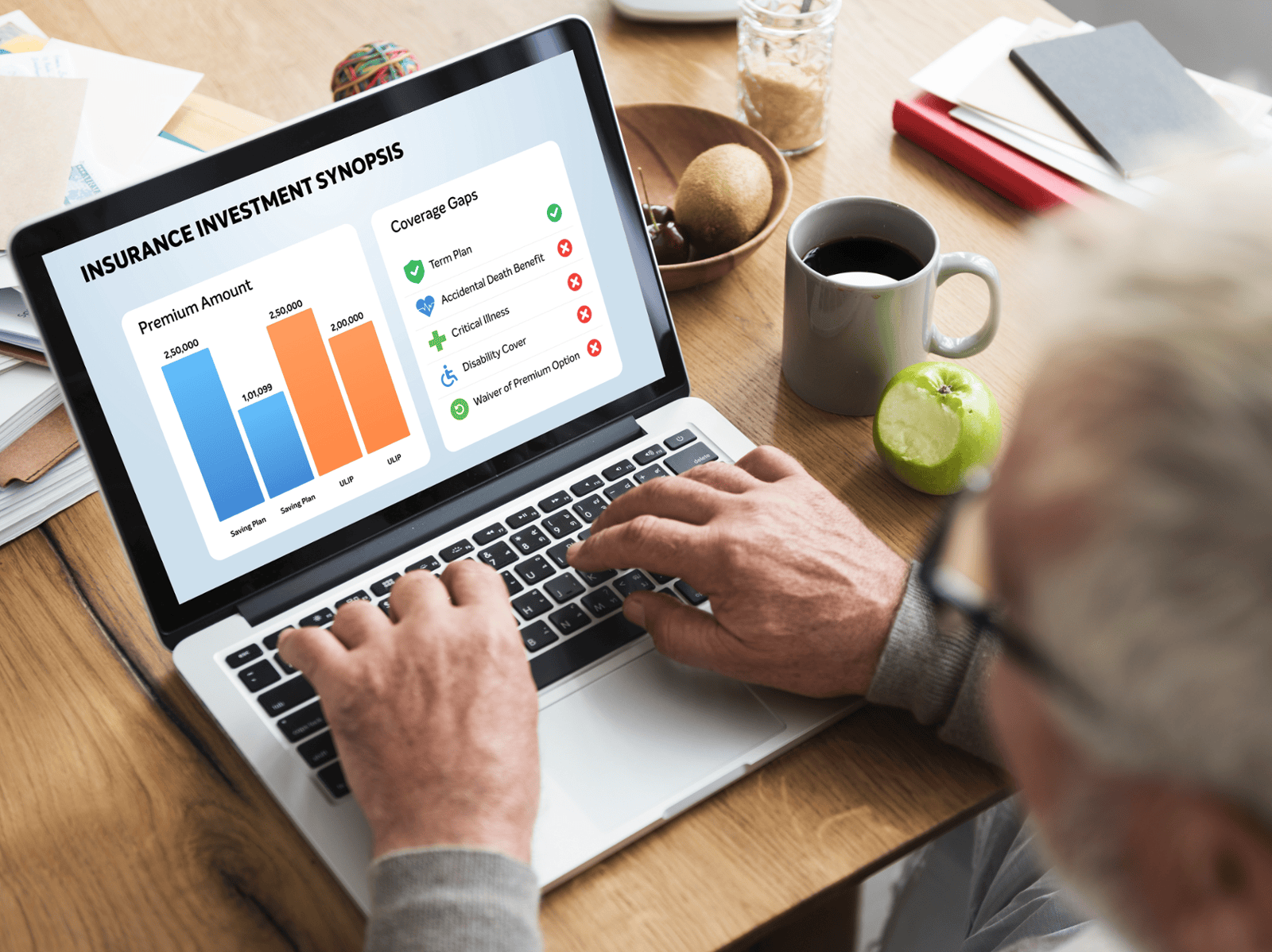

What is an

Insurance Policy Review?

An insurance review is a systematic analysis of your existing life, health, term, critical illness, and other policies. It ensures that your protection plan is adequate, cost-efficient, and aligned with your financial and family requirements.

What’s in it for you?

Ensures adequate protection for dependents and assets

Helps avoid over-insurance or under-insurance

Optimises costs and improves policy benefits

Ensures alignment with current lifestyle and future financial commitments

To identify better or more suitable policy availability aligned with current risk and assets

How we conduct an Insurance Policy review

at InCred Premier?

Once you share all the policies we evaluate the following points

01

Coverage adequacy analysis

for life, health, accidental, terminal illness, critical Illness, and long-term protection

02

Gap identification

to highlight missing or insufficient coverage.

03

Premium optimisation

to ensure you’re not overpaying.

04

Policy comparison

across insurers for better benefits and claim ratios.

05

Mapping coverage to future

financial goals

including education, liabilities, and retirement needs.

06

Review returns

to check if the policies chosen are worth to continue, meeting the inflation and future goals

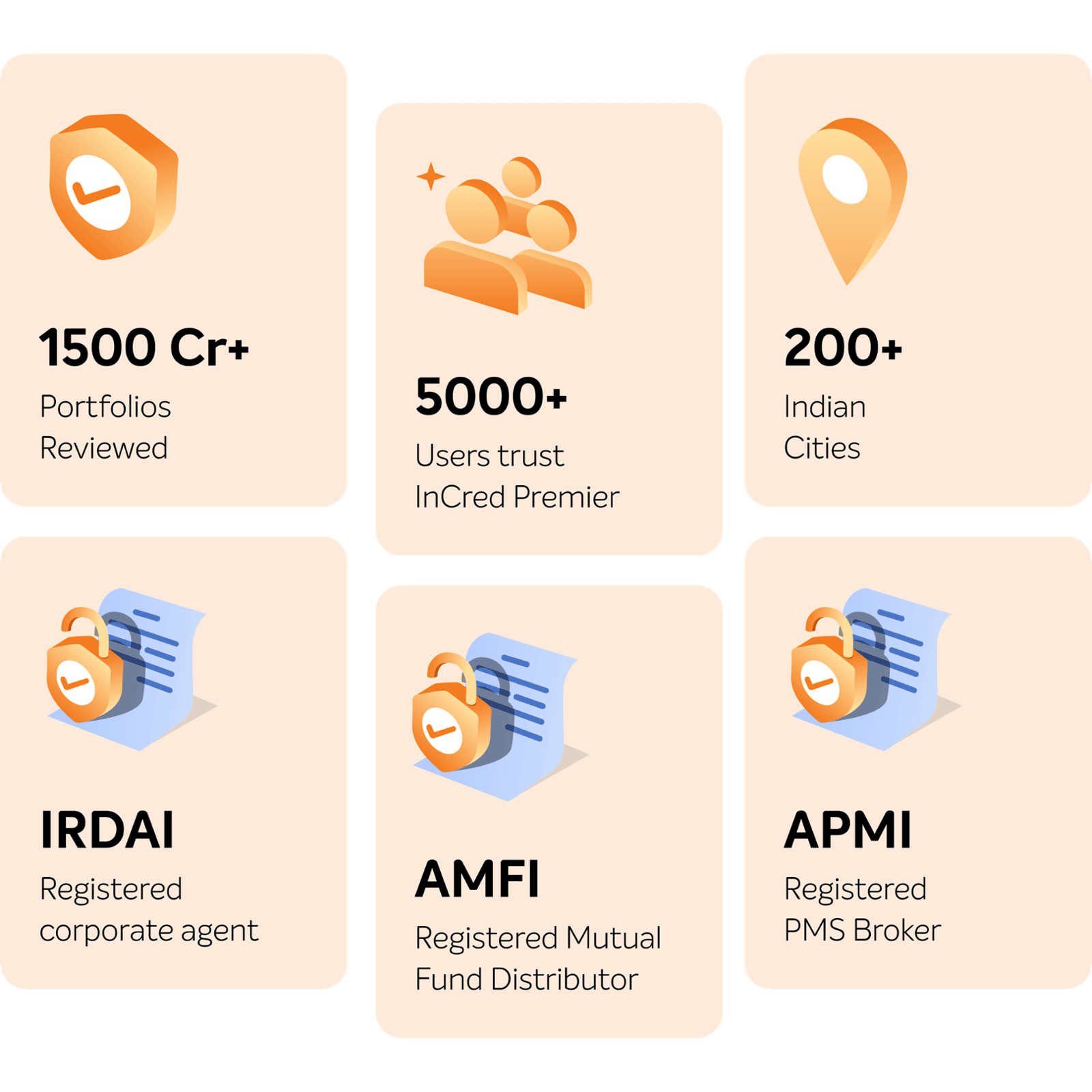

Numbers that matter

Your portfolio review is backed by deep,

data-driven research. We evaluate hundreds of mutual funds, ETFs, and company fundamentals to deliver insights rooted in rigorous analysis not surface-level trends. With years of market data and thousands of investment decisions assessed, you receive recommendations you can trust.

100%

safe & secure

InCred Premier uses industry-leading security systems to protect your data and ensure complete privacy.

Frequently Asked Questions

Media Coverage

Here’s what our clients say

My experience with InCred Premier has been nothing short of exceptional. The personalized guidance at every turn speaks volumes about their commitment to meeting the unique needs of clients like myself. Their astute guidance on investment products has not only instilled confidence but also empowered me to make strategic, well-informed decisions aligned with my financial aspirations. The dedication of the team to ensuring client satisfaction adds an extra layer of excellence, making InCred Premier my top choice for navigating the landscape of financial investments.

Mr. Vijay Chaudhary

Chairman of Land investment and asset management company

Being associated with InCred Premier as a client, I can confidently attest that their service surpasses my expectations. I've found that my Relationship Manager consistently provides guidance that aligns with my investment requirements. Even in situations where specialized knowledge is required, my relationship manager connects me with the experts to address my concems and queries. InCred Premier truly understands my needs and consistently delivers.

Mr. Rahul Agrawal

Co-founder & CIO of Technology Services Company

InCred Premier's approach to shaping a financial strategy is refreshingly straightforward, yet comprehensive. My risk profile and financial objectives were taken into account, to develop a financial plan which provided me with a robust roadmap. Adhering to it diligently has helped me realize some of my financial aspirations already. I genuinely hope individuals in similar financial positions recognize the value of professional assistance provided by InCred Premier in their financial journey.

Mr. Kushagra Nandan

MD & Co-Founder of Energy Company

Manas Malhotra

Director, Leading Garments Company

InCred Premier Distribution Private Limited (formerly known as Mvalu Technology Services Private Limited) is engaged in the business of distribution and sub-distribution of third-party financial products or acts as a referral agent for third-party financial products and services.

Investment Services

InCred Group

Customer Support

Disclaimer: InCred Premier Distribution Private Limited (formerly known as Mvalu Technology Services Private Limited) hereby known as "InCred Premier".

InCred Premier is an AMFI registered Mutual Fund Distributor under AMFI Registration Number: 275918 (valid from 07-09-2023 to 06-09-2026). InCred Premier is also

registered with APMI having registration no: APRN00175 and also acts in the capacity of a Corporate Agent; registered with IRDA having Licence number: CA0990.

Some services are offered through group companies. Mutual funds & Securities are subject to market risks, please read all your scheme/securities-related

documents carefully before investing.

CIN: U66220MH2018PTC313289

Registered Office and Corporate Office Address: Plot No. C, The Capital, Unit No. 1203, 12th floor, B Wing, 70, G Block Rd, Bandra Kurla Complex, Mumbai- 400051

Corporate Office Address: Unit 1201-1205, B Wing, 12th Floor, Kanakia Wallstreet, Andheri East, Mumbai – 400059

InCred Premier acts in capacity of a Corporate Agent; registered with IRDA having Licence number: CA0990

Investor grievance contact details

Email id: care@incredpremier.com

Tel number: 08047593769